2. Petitioner’s Federal Tax I.D. number is 94-1599959.

3. Petitioner has had its principal place of business and principal assets within this District for the preceding 180 days.

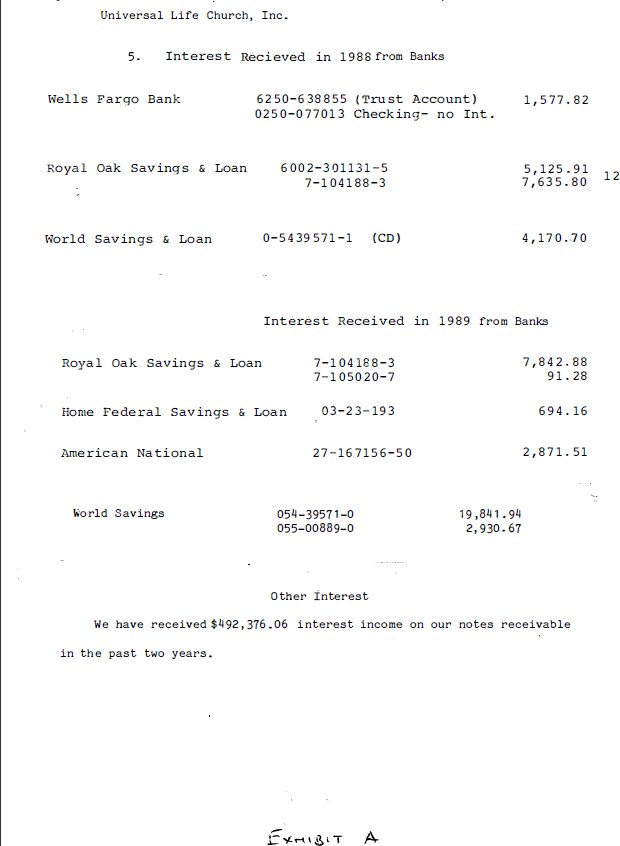

4. Exhibit “A” is attached to and made a part of this petition.

(a). Petitioner has not had a case pending under Title 11 at any time in the preceding 180 days where:

The case was dismissed by the Court for wilful failure of the debtor to abide by orders of the Court, or to appear

before the Court in proper prosecution of the case; or

(b) The petitioner requested and obtained the voluntary

dismissal of the case following the filing of a request for

relief from the automatic stay provided by Section 362 of Title 11.

6. Petitioner is qualified to file this petition and is

entitled to the benefits of Title 11, united states Code, as a voluntary debtor.

7. Petitioner intends to file a Plan pursuant to Chapter 11 of said Title 11.

WHEREFORE, Petitioner, UNIVERSAL LIFE CHURCH, a California non-profit corporation, prays for relief in accordance with Chapter 11 of Title 11, united states Code.

Dated: November 28, 1989

Respectfully Submitted,

ALTMAN, COLLINS & GROSS

Attorneys at Law

By:_______________________________________________

CARL W. COLLINS

Attorneys for Debtor

EXHIBIT “A”

1. Petitioner’s employer ID number is 94-1599959.

2. Petitioner has no securities reg istered under section 12 of the Securities and Exchange Act of 1934.

3. The following financial data is the latest available

information and refers to petitioner’s condition on

November 29, 1989:

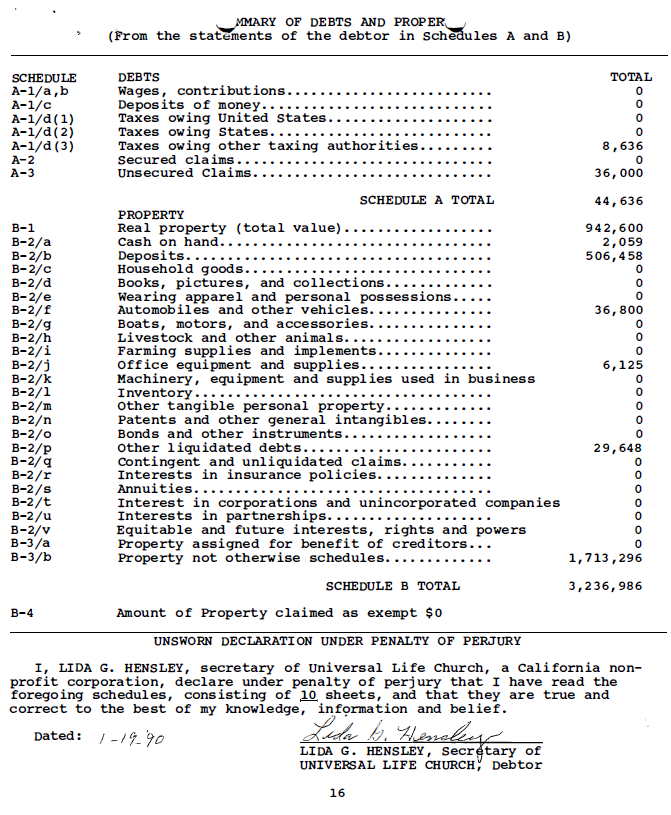

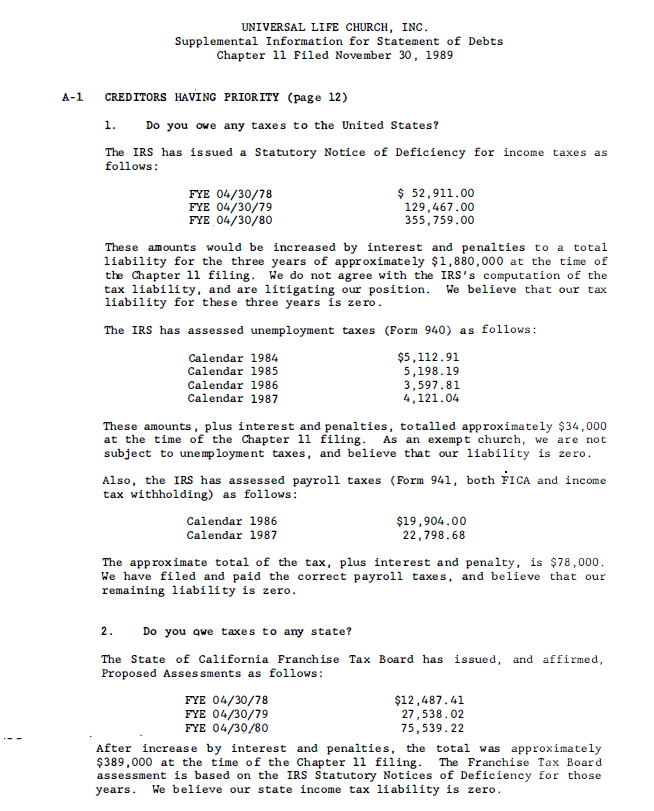

a. Total assets are approximately $3, 784, 548. 00

b. Total liabilities are unknown.

c. Secured debt, excluding that listed below totals $0. 00

and is held by approximately 0 creditors.

d. Debt securities held by more than 100 holders totals

$0. 00 and is held by approximately 0 creditors.

e. Secured debt totals $0. 00 and is held by approximately 0

creditors.

f. Unsecured debt is unknown and is held by approximately

20 creditors.

g. other liabilities, excluding contingent or unliquidated claims totals $0. 00 and is held by approximately 0 creditors.

h. Number of shares of common stock totals $0. 00 and is

held by approximately 0 creditors.

comments if any: none

4. The petitioner is a non-profit California corporation doing business as a tax exempt church under Internal Revenue Code

sections 501(c) (3) and (4) .

5. No person directly or indirectly owns, controls, or

holds, with power to vote, 20% or more of the voting securities

of petitioner.

6. Petitioner does not, directly or indirectly, own,

control, or hold, with power to vote, 20% or more of the

outstanding voting securities of any corporation.

UNITED STATES BANKRUPTCY COURT

FOR THE EASTERN DISTRICT OF CALIFORNIA

In Re: UNIVERSAL LIFE CHURCH, INC., Case No. 989-03284

California non-profit corporation Chapter 11 Case

STATEMENT OF AFFAIRS OF DEBTOR ENGAGED IN BUSINESS

1. NATURE, LOCATION, AND NAME OF BUSINESS

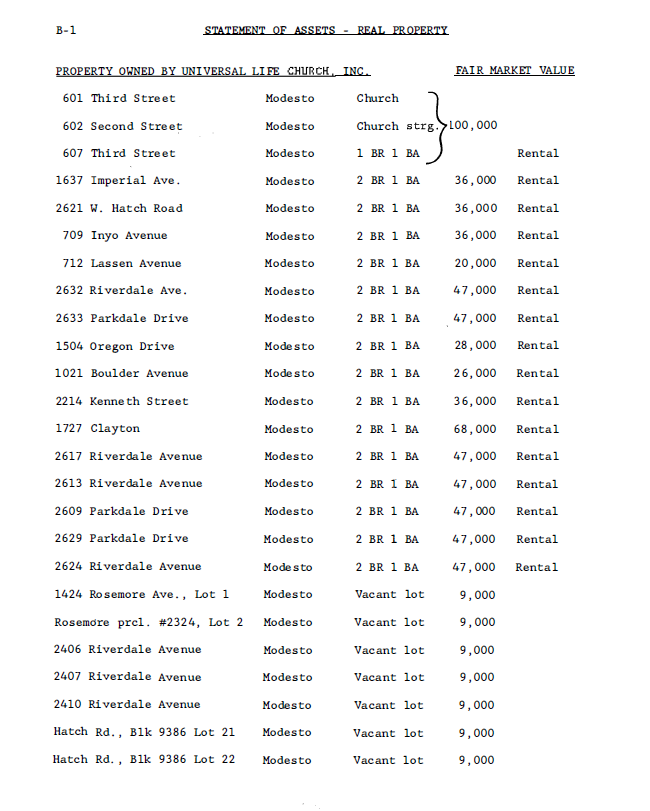

a. The petitioner carries on business under the name of UNIVERSAL CHURCH, a California non-profit corporation at 601 Third Street, California 95351.

b. The petitioner’s business is a church, featuring relig ious activities. Also active in social welfare, providing low housing income. Universal Life Church was incorporated in 1962. The low income housing program began in approximately 1977.

c.The petitioner has carried on business under the names and at the addresses listed below during the six years immediately preceding the filing of the original petition herein.

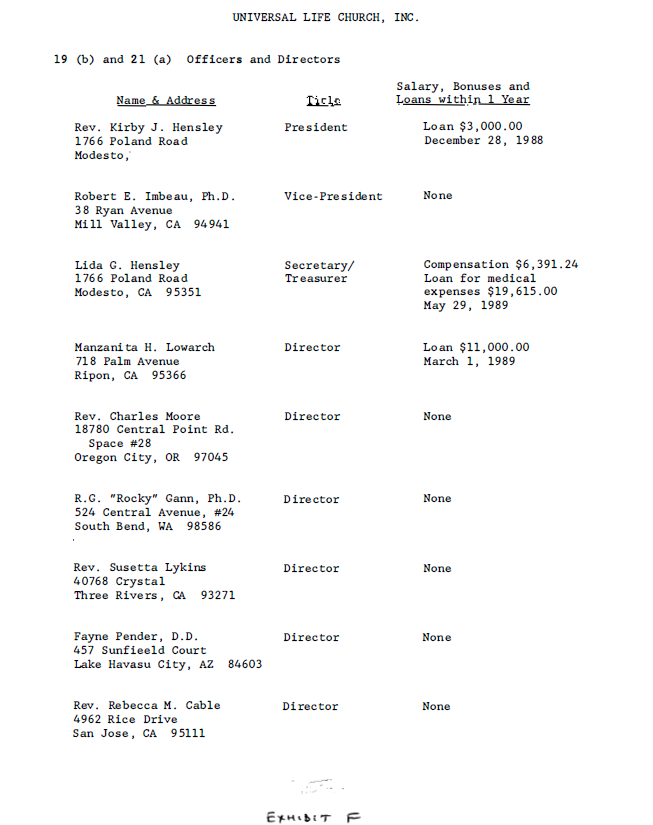

Numerous chartered congregations around the country operate under the name Universal Life Church, Inc. , under our mother church status. Formation of an unincorporated association called Universal Life Church began in November, 1988. It is a church headed by Reverend Kirby Hensley. It currently receives small donations from the general public and is operated out of the 601 Third Street, Modesto, California location .

d. The petitioner’s FEDERAL TAX employer identification number is 94-1599959.

2. BOOKS AND RECORDS:

a. During the two years immediately petition herein, the books of account and kept by or under the supervision of:

universal Life Church. As a tax-exempt tax returns or prepare financial statements.

b. During the two years immediately preceding the filing of the original petition herein, the books of account and records have been audited by:

None known to Petitioner.

11. PROPERTY. IN HANDS OF THIRD PERSON:

Thing s of value in which petitioner has as an interest are being held by: N/A.

12. SUITS, EXECUTIONS, AND ATTACHMENTS:

a. The petitioner was a party to the following suits pending at the time of the filing of the original petition herein:

See attached Exhibit “0”

b. within the year immediately preceding the filing of the original petition herein, the petitioner was a party to suits which were terminated, as follows:

See attached Exhibit “0”

c. within the year immediately preceding the filing of the original petition herein, property of the petitioner was attached, garnished, or seized under legal or equitable process, as follows:

None.

13. PAYMENTS ON LOANS AND INSTALLMENT PURCHASES:

During the year immediately preceding the filing of the orig inal petition herein, petitioner made repayments on loans in whole and in part, and made payments on installment purchases of goods and services, as follows:

None.

14. TRANSFERS OF PROPERTY:

a. During the year immediately preceding the filing of the original petition herein, the petitioner made gifts, other than ordinary and usual presents to family members and charitable donations, as follows:

None.

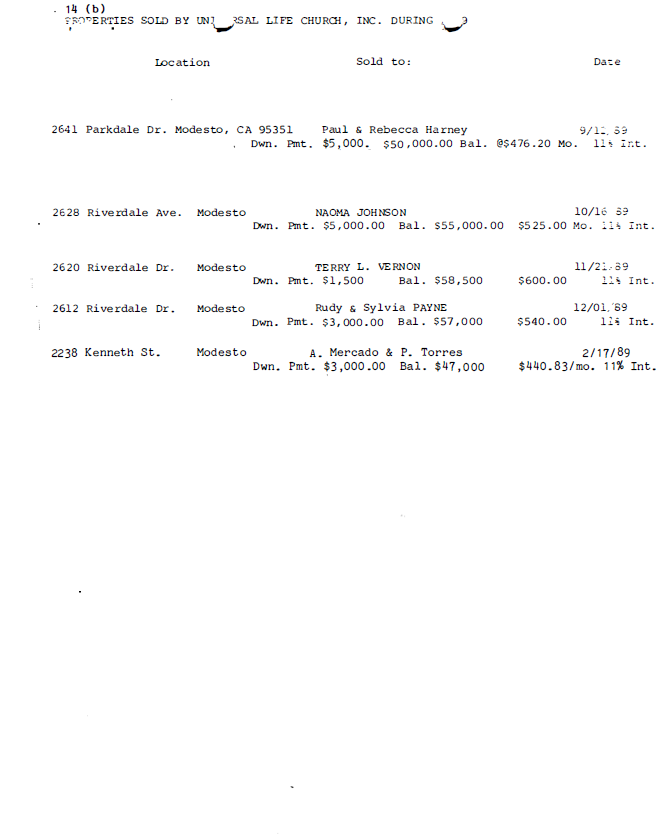

b. During the year immediately preceding the filing of the orig inal petition herein, the petitioner transferred or made other disposition, either absolutely or for the purpose of security, of property, as follows:

Sold 1974 GMC Motorhome to Rudy Eller in February 1989 for $12, 000;

Sold a Lincoln automobile to Manzanita Lowarch in March 1989 for $11, 000;

Sold a Chevy van to Gary Hensley in June 1989 for $4, 500; See attached

Exhibit “E” for sales of real property.

(a) Lawsuits pending at this time:

1) Garber vs. City of Philadelphia, ULC et al.

Court of Common Pleas of Philadelphia County Dkt #6679 (“Trespass”)

2) USA vs Flagship Bank of Miami and Barnett Bank, N.A.

ULC ( Brenaan E. Love) ULC, Intervenor US District Court for the Southern District of Florida Dkt #Bô€‡-2675-UV-EPS/ 83-2674-CIV-EPS Tax Liability of Brendan E. Love

3) McManus vs. ULC, et, al.

Circuit Court of the State of Oregon for County of Baker Dkt *97-113 strict Foreclosure of Contract For Sale of Real and Personal Property

4) Richardson and Reed vs. Kinchloe and ULC

Court of Cornmon Pleas of Philadelphia County Dkt #4796 Personal Inj ury

5) State of Oregon vs. ULC, et, al.

Circuit Court: Marion, Oregon Dkt #87L-11707 Racketeering

6) Skach vs. ULC, USA

U.S. District Court, Northern District of I l linoi s , Eastern Division Dkt #86-C-3497 Quite Title

7) Qlatunloosesn vs. Reed, ULC

us District Court of Harris County , Texas Dkt #82-63664 Personal Injury

8) Miller & WeBS, Ltd., et, al, vs. Mount Taylor ULC, et. al.

District Court , Bernalillo, New Mexico CV-83-06955 Fraudulent Conveyance

9) Monarch Industries vs. ULC, et, al.

Circuit Court; Broward, Florida Dkt #84-14106CoJ Breach of Contract

10) Movers ys. Moyers

Superior Court of New Jersey; Chancery Division, Monmouth county Dkt *08217-83 Quite Title

11) State of Texas vs. ULC, pusha

District Court of Bixar County, Texas DKT #88-C1-03318: Violation of Provisions of Section 3 of the TFDCA (Texas, food, Drug and cosmetic Act)

12) NMC Inc., vs. ULC, et, al.

Circuit Court; Broward County, Florida Dkt #84-03925 CT Breach of contract

13) Town of Paradise vs. Meggish, ULC.

Superior Court of CA, County of Butte Dkt #94564 Permanent Injunction

14) ULC vs. Commissioner of Internal Revenue -Tax Court

US Tax Court, Washington, PC Petition for redetermination of deficiency set forth by commissioner Dkt ô€«8288-85

15) ULC. Free Enterprise Investments vs. Commissioner of Internal Revenue

US Tax Court , Washington, DC Dkt #16669-87 Petition for readjustment of partnership Hans set forth by Commissioner

16) Comark, pebtor vs. ULC, et, al.

US Bankruptcy court, Central District of CA. SA 82-03SS0-RP Complaint for (1) recovery of preferential transfers, (2) turnover of property of the estate

17) ULC vs IRS

US District Court for Northern District of CAL-86-20760-SW Complaint for Inj unctive and Declatory Rel ief

18) Morlarity vs. ULC, et. al.

Municipal Court, south Orange County, LA Dkt # 32506 Complaint for Money

19) USA and David Eichel vs. ULC

US District Court , Eastern District of CA CV-F-a7-470 EDP Summons Enforcement Matter

20) Stanbol vs. ULC, et. al.

Superior Court of CA, San Luis Obispo County Dkt #59590 Quiet Title

21) ô€…«ea Ridge Village Homeowners As sociation vs ULC

Superior court of CAi county of Los Angeles Dkt #L462928 Judicial Foreclosure

22) ULC. Emergenc¥ Chri§tian Care Church of Christ VS. Robers, et

U.S. District court, western Division of Texas, El Paso Division #EP-86-CA-169 Personal Injury

23) Hilliams ys. ULe, et al,

US Bankruptcy Court; Eastern Disctrict of CA Dkt #181-02930 Matter of Renee ‘ Van Asten Petersen, Debtor

24) Dickens

District Court of Harns County, Texas Okt #84-67489 Matter of Marriage of Barbara Dickens and Gene Dickens

25) Twohy vs. Lasley, ULC, et, al

superior court of CA; county of Riverside Dkt # 185397 Rescission of Gift

26) Forguson ys ULC

Ssuperior ct. of CA: county of Riverside Dkt #163624 Complaint for Damages

27) Appeal of ULC

State Board of Equalization – Sales Tax Proposal Deficiency Dkt #89a-0186

28) Sonocki vs . GlUCKsman, ULe

superior Court of CA, LA county Dkt # L-611925 Quiet Title

29) City of Vacaville vs. ULC, et, al.

Superior court of state of CA; county of Solano Dkt #105723 Eminent Domain

30) Miceli vs. ULC

Us District Court of Colorado 87-c-835 Complaint for Damages

31) Kaiser steel Corp., et. al. ULe

US Bankruptcy Court of Colorado 89-E-154 Adversary Proceeding, Re: Kaiser Steel, Debtor

32) Cerny, ULC vs. USA

US Claims Court Dkt #696-88T Refund Claim

33) Cobble vs. Cobble, ULC, et. al

Superior Court of CA, Solano County Dkt # 95736 Complaint to set aside Fraudulent Conveyance and for Damages

34) Northwest Federal Savings BAnk vs. ULC, et, al.

Iowa District court for Clay county Equity No. 22433 Petitioner in Equity (Foreclosure)

35) General Federal Savings and Loan Association vs. ULC, cusgac, ULC, et, al.

17th Judicial Court of Broward County, Florida Dkt #86-2B475 CD Sale and Foreclosure

36) Commercial Western Finance Corp. VB. ULC, Inc.

US Bankruptcy Court for Northern District of CA Dkt #3-81-01779-LK Bankruptcy

37) ULC vs. Commissioner (J’s State Board of Equalization

US Bankruptcy Court -Eastern District of CA Dkt #989-3284 Debtor, Bankruptcy; Chapter 11 case

38) Gardenier, et al . vs. Bettin, Universal Life Church, Inc., et al .

Los Angeles County Superior Court, Central Division, Los Angeles, CA C-559-706 Quiet title

39) Cimarron Oaks III Homeowners Association vs. Universal Life Church, Inc., et al.

San Bernardino County MuniCipal Court, West Valley Judicial District Dkt #47082 Foreclosure

40) Title Insurance and Trust COffipany et al., vs. Universal Life Church, Inc.

Stanislaus County Superior Court, Modesto, CA Did #186608 Quiet title and related cross-actions

41) Universal Life Church, Inc. vs. Clay, Shaw, et al.

Stanislaus County Superior Court, Modesto, CA Dkt 11184707 Quiet Title

42) Cobble vs. Cobble, Universal Life Church, Inc., et al.

Solano County Superior Court, Fairfield, CA Dkt 1195736 Complaint for Fraud

12 (b) Lawsuits terminated within one year:

1) Forguson vs. Universal Life Church, Inc., et al. Superior Court of California, County of Riverside Dkt 1116362 4 Action on Contract

2 ) Universal Life Church, Inc., vs. Johnni Gray

Stanislaus County Municipal Court, Modesto, CA

Dkt 1/13772 4

Unlawful Detainer

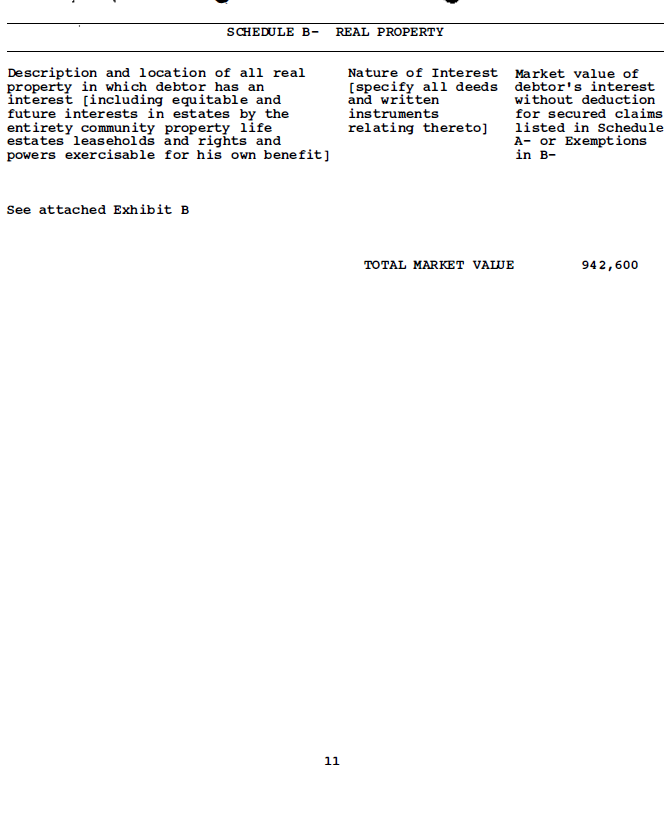

Type of Property Description and Location Market value of debtor’s interest without deduction for secured claims listed in Schedule A-2 or Exemptions in B-4

(a) Cash on hand: 2, 059

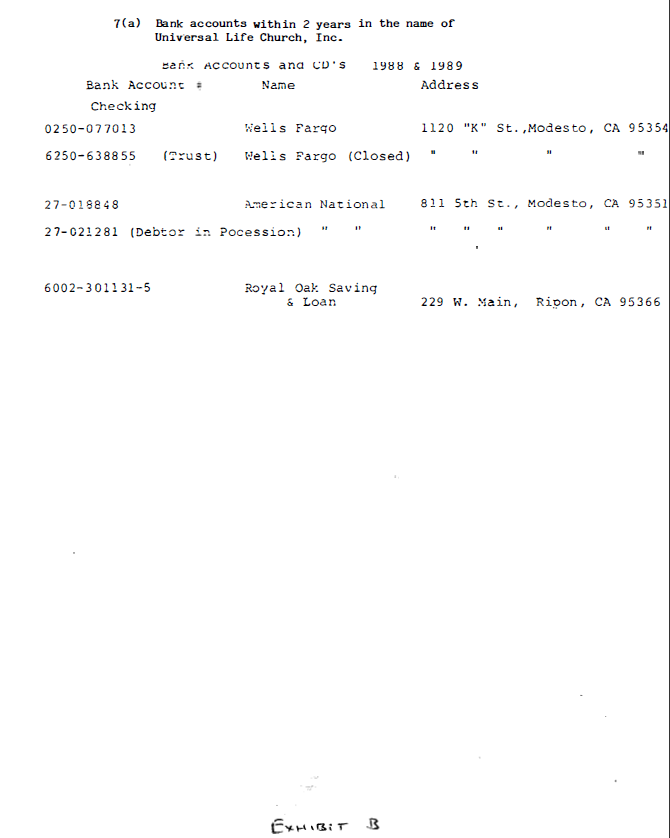

(b) Deposits of money with banking institutions, loan associations, credit unions, public utilities, landlords, etc: 506,458

(c) Household goods, supplies and furnishings: 0

(d) Books, pictures and other and other art objects; stamp, coin, and other collections: 0

(e) Wearing apparel, jewelry, firearms, sports equipment and other personal possessions: 0

(f) Automobiles, trucks, trailers, and other vehicles: 36,800

1973 GMC Motorhome

1979 Chevy pick-up

1988 Buick

1981 Chevy Motorhome

1978 Chevy Van (sold June 1989, but title has not yet transferred)

(g ) Boats, motors and their accessories: 0

(h) Livestock, poultry, and other animals: 0

(i) Farming equipment, supplies and implements: 0

(j) Office equipment, furnishings, and supplies: 6, 125

(k) Machinery, fixtures, equipment, and supplies [other than those listed in items (j) and (1)] used in business: 0

(1) Inventory: 0

(m) Tangible personal property of any other description: 0

(n) Patents, copyrights, franchises, and other general intangibles (specify all documents and writings related thereto) : 0

(o) Government and corporate bonds and other negotiable and non negotiable instruments:

(p) Otner liquidated debt owing debtor: 29,648 (Face Value of $59,296, discounted 50%)

(q) Contingent and unliquidated claims of every nature, including 0 counter claims of the debtor (give estimated value of each):

(r)Interests in insurance policies (name insurance company of each policy and itemize surrender or refund value of each): 0

(s) Annuities (itemize and name each issuer): 0

(t) stock and interests in incorporated and unincorporated companies (itemize separately): 0

(u) Interests in partnerships: 0

(v) Equitable and future interest, life estates, and rights or powers exercisable for the benefit of the debtor (other than those listed in Schedule B-1) [specify all written instruments related thereto] : 0

TOTAL MARK ET VALUE 581,090

Type of Property Description and Location Market value of debtor’s interest without deduction for secured claims listed in Schedule A-2 or Exemptions in B-4

(a)Property transferred under assignment for benefit of creditors, within 120 days prior to filing of petition (specify date of assignment, name and address of assignee, amount realized there from by the assignee, and disposition of proceeds so far as known to debtor: o

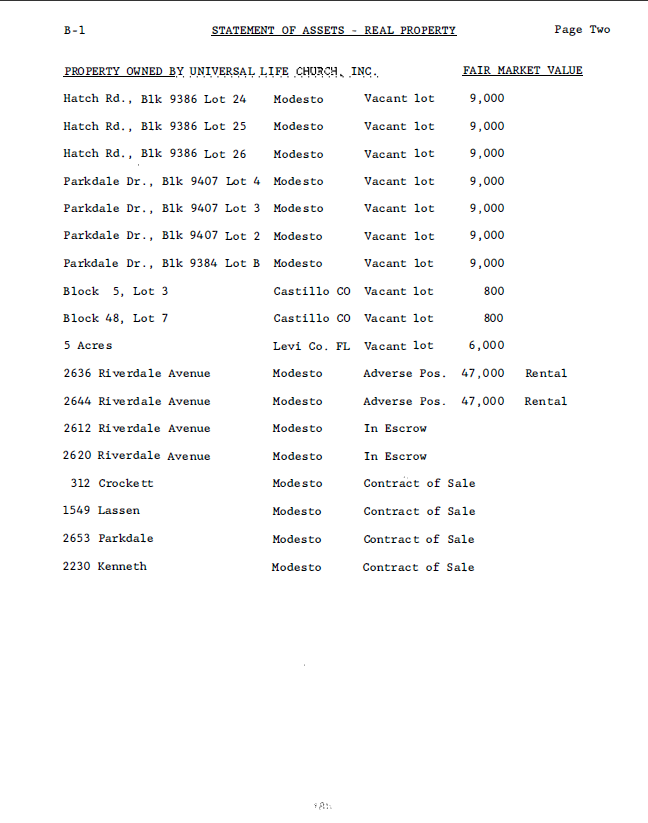

(b)Property of any kind not otherwise scheduled:

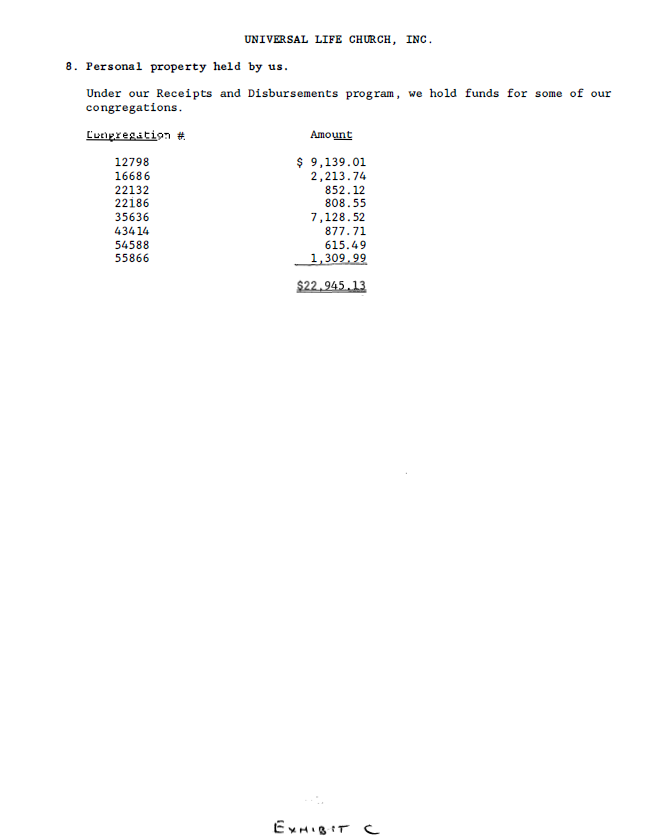

Notes Receivable on real property sales, face value $2,327,522 discounted 30% 1,629,265

Real property in escrow (2612 and 2620 Riverdale) included at cash received from escrow December 1989 of $3,180.64 plus 30% discount on notes of $115,500 face value. 84,031

TOTAL MARK ET VALUE 1,713,296

Type of

Property

Location, and description, statute and section Value and so far as relevant to creating exemption claimed claim of exemption, present exempt use of property

TOTAL VALUE CLAIMED EXEMPT o